Sciwind Biosciences Co., Ltd. announced that the National Medical Products Administration (NMPA) has approved ecnoglutide for glycemic control in adult patients with type 2 diabetes, making it the world’s first marketed cAMP‑biased GLP‑1 receptor agonist. The approval marks a significant innovation in the GLP‑1 class, which is dominated by non‑biased agonists.

Regulatory Milestone & Drug Profile

| Item | Detail |

|---|---|

| Company | Sciwind Biosciences Co., Ltd. (China) |

| Drug | Ecnoglutide |

| Approval | NMPA marketing authorization |

| Indication | Glycemic control in adult type 2 diabetes patients |

| Innovation | World’s first cAMP‑biased GLP‑1 receptor agonist |

| Mechanism | Preferentially activates cAMP signaling, minimizes β‑arrestin recruitment |

| Clinical Basis | Phase III studies EECOH‑1 (monotherapy) and EECOH‑2 (metformin combination) |

Mechanism of Action & Differentiation

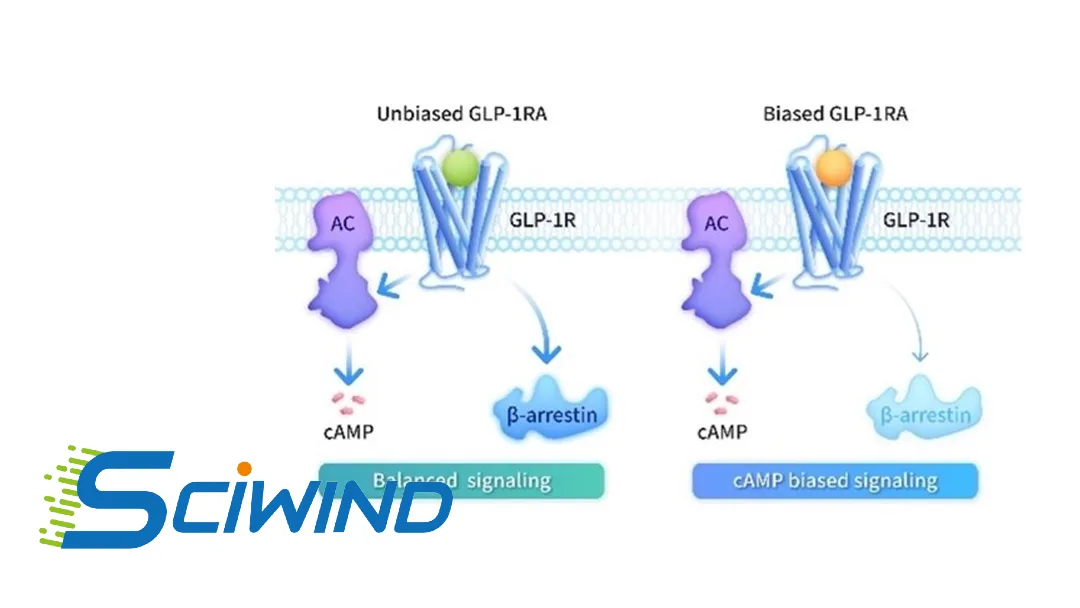

- Signaling Bias: Unlike traditional GLP‑1 receptor agonists, ecnoglutide preferentially activates the cAMP pathway while limiting β‑arrestin recruitment

- Clinical Advantage: Reduced β‑arrestin signaling limits receptor desensitization and downregulation, allowing more receptors to remain on the cell surface for sustained therapeutic signaling

- Enhanced Efficacy: cAMP bias helps improve glycemic control, weight reduction, and metabolic benefits compared to non‑biased agonists

Phase III Clinical Data

| Study | Design | Key Findings |

|---|---|---|

| EECOH‑1 | Monotherapy in Chinese T2D patients | Sustained glycemic control, weight loss, metabolic improvement over 52 weeks |

| EECOH‑2 | Combination with metformin | Significant A1C reduction, favorable safety profile maintained |

| Common Results | Both studies | Sustained efficacy over 52 weeks, overall favorable safety and tolerability |

Market Impact & Commercial Outlook

- China GLP‑1 Market: Valued at ¥50 billion : (~US$7 billion) in 2025, growing at 25% CAGR driven by obesity and diabetes demand

- Competitive Landscape: Ecnoglutide enters market dominated by semaglutide (Novo Nordisk) and tirzepatide (Lilly); cAMP‑biased mechanism offers differentiation

- Revenue Potential: Analysts project ¥3–5 billion (US$420–700 million) peak annual sales by 2030, assuming 5–8% market share in China’s GLP‑1 segment

- Strategic Value: Positions Sciwind as an innovator in next‑generation GLP‑1 therapies with global franchise potential

- Next Steps: Commercial launch expected Q2 2026; potential ex‑China partnership discussions underway

Forward‑Looking Statements

This brief contains forward‑looking statements regarding commercial launch timelines, market penetration, and revenue projections for ecnoglutide. Actual results may differ due to competitive dynamics, market adoption rates, and pricing negotiations.-Fineline Info & Tech