Junshi Biosciences (HKG: 1877; SHA: 688180) has released its financial results for the third quarter of 2024, reporting revenues of RMB 1.271 billion (USD 178.36 million) for the first three quarters, marking a 28.87% year-on-year (YOY) increase, and a net loss of RMB 927 million (USD 130 million). The third quarter alone saw revenues of RMB 485 million (USD 68 million), up 53.16% YOY, and a net loss of RMB 282 million (USD 39.6 million).

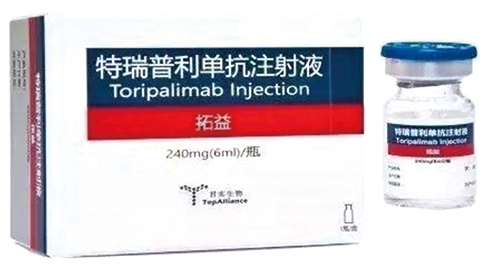

The growth in revenues was primarily attributed to the increased sales of commercialized drugs, with the core product Tuoyi (toripalimab), a programmed death-1 (PD-1) inhibitor, leading the way. Tuoyi generated sales of RMB 1.068 billion (USD 149.9 million) in the first three quarters, up 60% YOY, and RMB 397 million (USD 55.7 million) in the third quarter, up 79% YOY. The company continued to enhance cost control and allocate resources to more promising R&D projects, which contributed to reduced losses. As of the reporting period’s end, the total balance of the company’s monetary funds and trading financial assets stood at RMB 3.045 billion (USD 427.3 million), indicating a healthy financial reserve.

During the period, ongericimab (JS002), a PCSK9 monoclonal antibody (mAb), received approval in China for the treatment of adult patients with primary hypercholesterolemia (non-familial) and mixed dyslipidemia. Additionally, JS125 (WJ47156), a histone deacetylases (HDAC) inhibitor co-developed with Wigen Biomedicine Technology (Shanghai) Co., Ltd, was granted clinical trial clearance in China.- Flcube.com