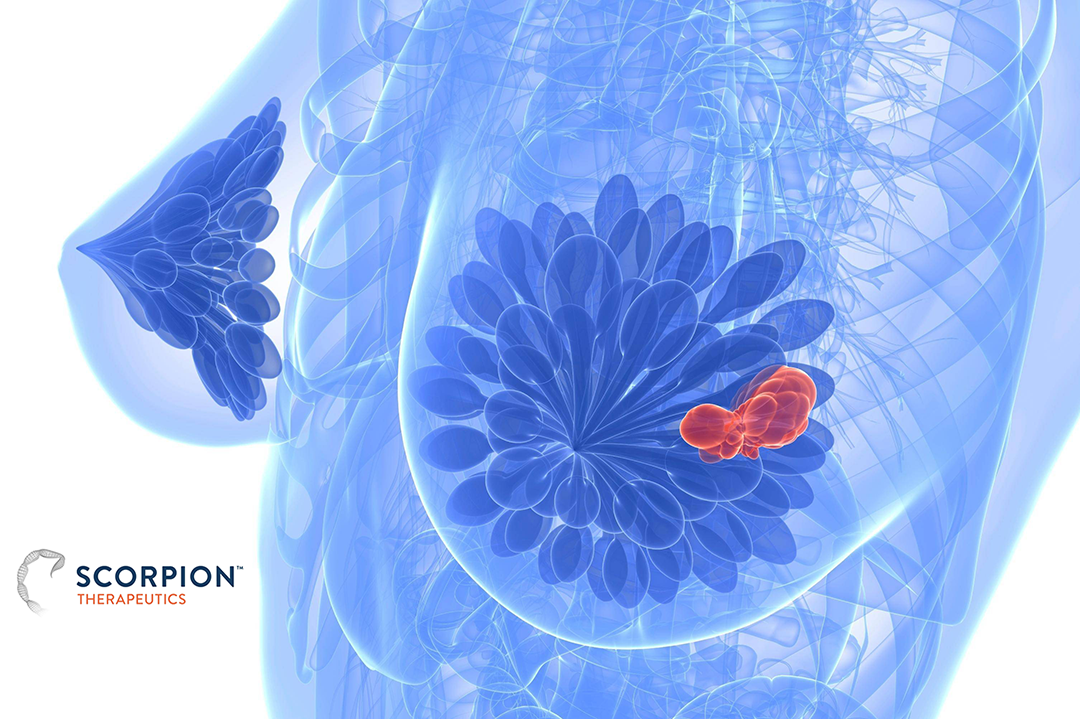

US-based pharmaceutical giant Eli Lilly and Company (NYSE: LLY) is set to acquire STX-478 from its compatriot firm Scorpion Therapeutics, Inc. STX-478 is a mutant-selective PI3Kα inhibitor currently being studied in a Phase I/II clinical trial for the treatment of breast cancer and other advanced solid tumors. This strategic move aims to expand Eli Lilly’s oncology portfolio and enhance its capabilities in targeted therapies.

Acquisition Terms and Financials

Under the terms of the agreement, Eli Lilly will acquire Scorpion Therapeutics, and Scorpion’s shareholders could receive up to USD 2.5 billion in cash. This includes an upfront payment and subsequent payments upon the achievement of certain regulatory and sales milestones. The transaction is structured to provide significant value to Scorpion’s shareholders while aligning with Eli Lilly’s strategic objectives.

Spin-Out of New Entity

As part of the transaction, Scorpion will spin out a new entity to hold its employees and non-PI3Kα pipeline assets. The new, independent company will be owned by Scorpion’s current shareholders, with Eli Lilly holding a minority equity interest. This spin-out allows Scorpion to focus on its other promising assets while providing Eli Lilly with exclusive access to STX-478, a key asset in the development of targeted cancer therapies.

Strategic Implications for Eli Lilly

The acquisition of STX-478 represents a significant step forward in Eli Lilly’s commitment to developing innovative therapies for patients with advanced cancers. By integrating STX-478 into its pipeline, Eli Lilly aims to accelerate the development of new treatment options and improve patient outcomes in breast cancer and other solid tumors. This move underscores Eli Lilly’s ongoing efforts to invest in and bring forward transformative medicines to the market.-Fineline Info & Tech