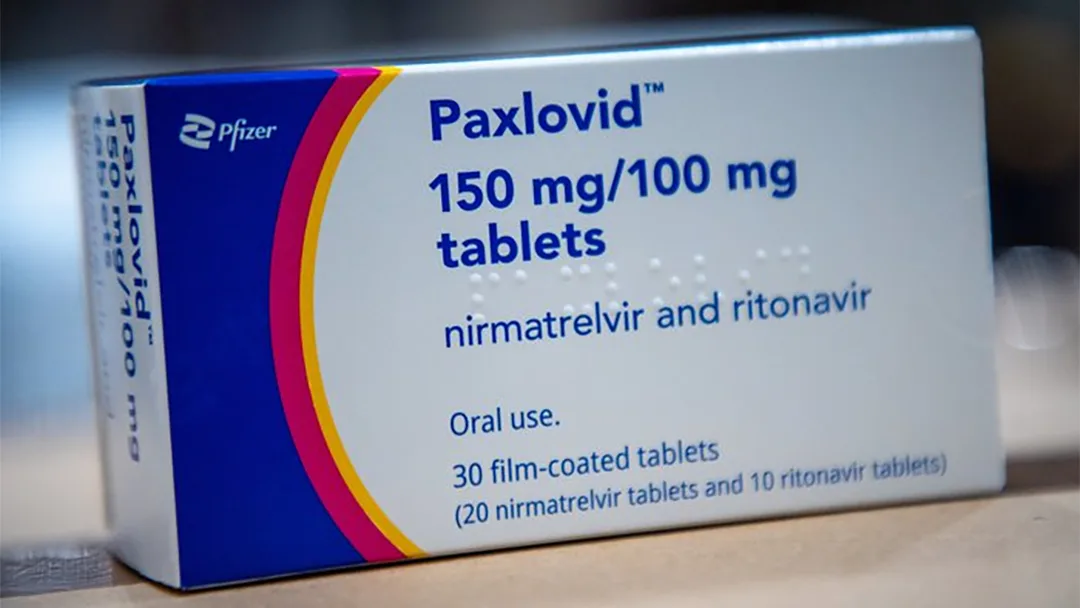

US-based Pfizer Inc. (NYSE: PFE) released its Q1 2025 financial results, showing a -6% year-on-year (YOY) decrease in revenues in constant currency terms to USD 13.7 billion. The decline was primarily attributed to falling sales of COVID-19 therapy Paxlovid (nirmatrelvir/ritonavir) and the impact of the Inflation Reduction Act (IRA) Medicare Part D Redesign on core drugs.

IRA-Impacted Drug Sales

In terms of drugs affected by the IRA, blood thinner Eliquis (apixaban) saw sales decline by -4% to USD 1.92 billion, arthritis drug Xeljanz (tofacitinib) fell -31% to USD 128 million, and breast cancer therapy Ibrance (palbociclib) dropped -6% to USD 977 million.

Portfolio Highlights

Despite these challenges, Pfizer’s portfolio also saw several positive developments:

- Rare disease drug Vyndaqel (tafamidis, also known as Vyndamax or Vynmac) achieved 33% global sales growth, reaching USD 1.5 billion despite higher discounts required by IRA Medicare reforms.

- COVID-19 vaccine Comirnaty recorded 62% YOY growth to USD 565 million.

- Urothelial cancer drug Padcev (enfortumab vedotin) saw 25% growth to USD 426 million.

- Migraine therapy Nurtec ODT (rimegepant) expanded by 40% to USD 248 million.

- Lung cancer therapy Lobrena (lorlatinib) grew by 39% to USD 222 million.-Fineline Info & Tech