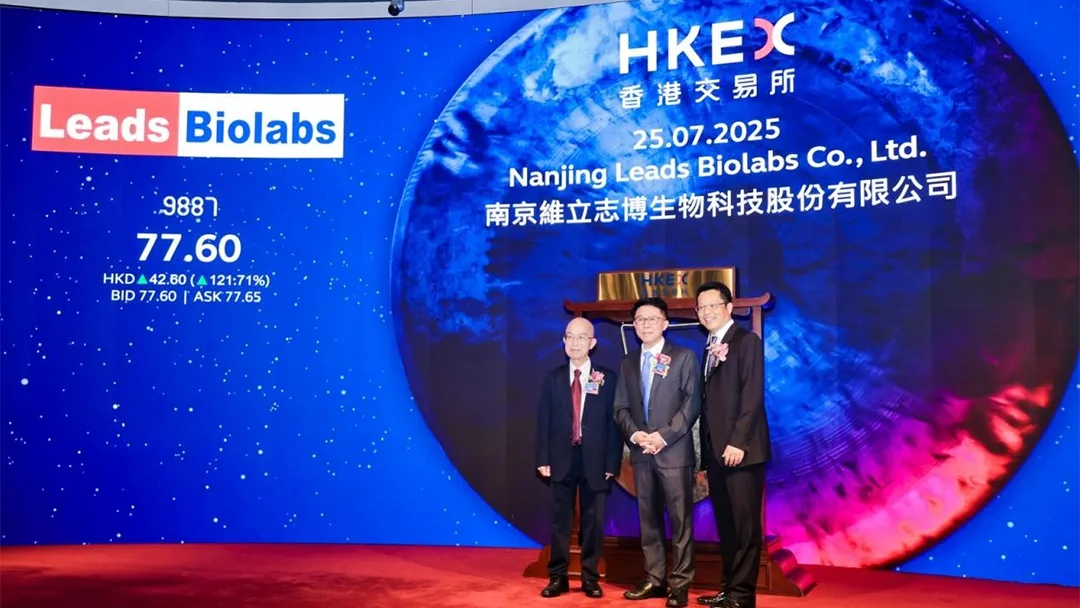

China-based Leads Biolabs (HKG: 9887) officially listed on the Main Board of the Hong Kong Stock Exchange on July 25, 2025. The initial public offering was priced at HK$35 per share, with an expected gross proceeds of up to $189 million (including the over-allotment option).

Investor Participation

The IPO attracted nine cornerstone investors who committed approximately $69 million in total. These investors include Loyal Valley Capital, Gaoyi, OrbiMed, TruMed, Tencent, E Fund, RuYuan, SAGE, and HanKang Capital. Morgan Stanley and CITIC Securities (Hong Kong) served as joint sponsors.

Funds Allocation

The net proceeds from the offering are primarily allocated to:

- Ongoing and planned clinical development and regulatory affairs for its clinical-stage drug candidates.

- Advancing preclinical assets, expanding the existing pipeline, and optimizing technology platforms.

- Enhancing production capacity and commercialization efforts following drug approval.

Company Background

Founded in 2012, Leads Biolabs is a clinical-stage biotechnology company focused on treating cancer, autoimmune diseases, and other major illnesses. The company has a pipeline of 14 innovative drug candidates, six of which have entered clinical development.

R&D Platforms

Leads Biolabs’ proprietary R&D platforms include LeadsBody (CD3 T-Cell Engager platform) and X-body (4-1BB Engager platform). These platforms provide the company with full-chain capabilities from antibody discovery to clinical development.-Fineline Info & Tech