Argo Biopharma, a Shanghai‑based siRNA drug developer, announced a new strategic cooperation agreement with Novartis (NYSE: NVS). The deal deepens an already‑existing collaboration and opens the door to multiple cardiovascular products.

Key Deal Elements

| Feature | Detail |

|---|---|

| Option Rights | Novartis receives out‑of‑China option rights for two early‑stage molecules targeting severe hypertriglyceridemia (sHTG) and mixed dyslipidemia. |

| First‑Negotiation Right | Novartis holds the right of first negotiation for BW‑00112 (ANGPTL3), a Phase 2 candidate in the U.S. and China. |

| Exclusive License | For a pre‑clinical siRNA candidate, Novartis obtains an exclusive out‑of‑China license and a reciprocal profit‑and‑loss sharing option in the U.S. and China. |

| Clinical Milestones | BW‑00112 will proceed to combination‑therapy trials under Argo’s leadership; the pre‑clinical candidate is slated for Phase I in 2026. |

| Financial Terms | Argo receives a $160 M upfront payment, with potential milestone and option payments totalling up to $5.2 B and tiered royalties on commercial sales. |

| Future Equity | Novartis has signaled a preliminary interest in Argo’s next equity round, subject to due diligence and final negotiations. |

Strategic Rationale

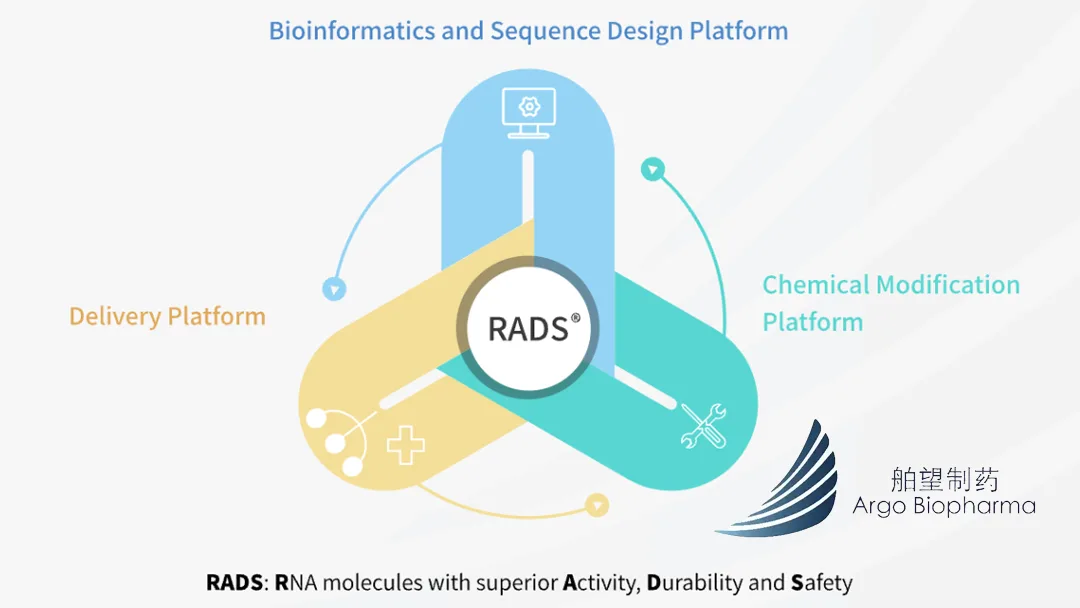

- siRNA Platform Synergy – Argo’s platform delivers precise gene‑silencing, while Novartis brings deep cardiovascular expertise and global commercialization capabilities.

- Portfolio Expansion – The collaboration targets unmet needs in hypertriglyceridemia and mixed dyslipidemia, diseases with limited therapeutic options.

- Risk‑Sharing – The profit‑and‑loss sharing mechanism aligns incentives and mitigates development risk for both parties.

Outlook

The partnership positions Argo Biopharma to accelerate the pipeline of cardiovascular siRNA therapies. With Novartis’s global reach, the drug candidates could reach regulatory approval and market launch within the next 4–5 years, delivering significant upside to both companies and their shareholders.-Fineline Info & Tech