China‑based Baheal Pharmaceutical Group (SHE: 301015) announced a strategic cooperation agreement with Tianjin Jikun Pharmaceutical Technology Co., Ltd. Under the deal, Baheal will invest in Jikun, taking a 24 % equity stake and securing exclusive rights to the advanced anti‑fibrotic candidate JK1033.

Deal Highlights

- Equity Investment: Baheal acquires a 24 % stake in Jikun Medicine.

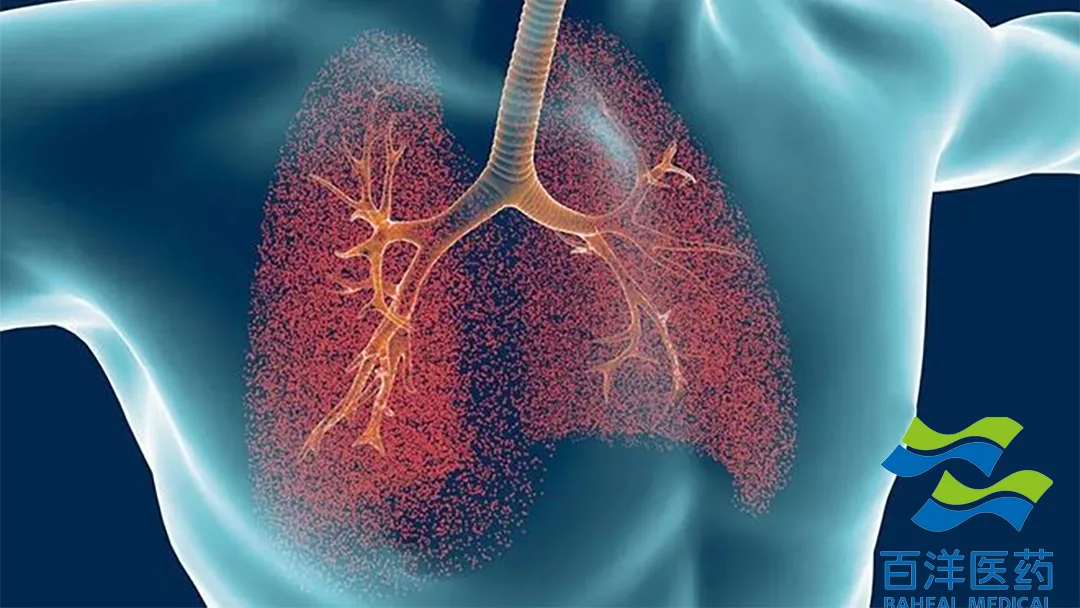

- Exclusive Rights: Baheal obtains full rights to JK1033, a Class 1 innovative drug targeting pulmonary fibrosis.

- Right of First Refusal: Baheal gains the right of first refusal—on equal terms—to purchase global compound rights for all remaining Jikun products.

JK1033: A Breakthrough Anti‑Fibrosis Candidate

JK1033 is a small‑molecule compound derived from traditional Chinese medicine monomers and their derivatives. Key points:

- Target Indications: Idiopathic pulmonary fibrosis (IPF) and progressive pulmonary fibrosis (PPF).

- Development Milestones: Completed pharmacology, PK/PD, and pre‑IND consultation with the U.S. FDA.

- Clinical Progress: Initiated Phase I trial in China (January 2025) and now poised to submit an IND application.

Strategic Implications for Baheal

- Portfolio Expansion: The acquisition adds a late‑stage, potentially market‑disruptive asset to Baheal’s pipeline.

- Global Reach: The right of first refusal positions Baheal to secure worldwide rights to Jikun’s future assets, broadening its international footprint.

- Risk Mitigation: With a 24 % stake, Baheal retains significant upside while sharing development risk with Jikun.

Implications for the Chinese Pharma Landscape

- Innovation Collaboration: The deal exemplifies the growing trend of domestic pharma consolidating expertise to accelerate drug development.

- Pulmonary Fibrosis Market: JK1033 may become a first‑in‑class therapy, addressing a high‑unmet‑need patient population in China and globally.

- Regulatory Momentum: The timely FDA pre‑IND consultation signals Baheal’s commitment to pursuing an international commercialization strategy.

Forward‑Looking Statements

Baheal’s leadership emphasized that the partnership “aligns with our strategy to invest in high‑potential, late‑stage assets and to expand our global reach.” The company expects the deal to close in the next quarter, contingent on customary regulatory approvals.-Fineline Info & Tech