Henlius Biotech Inc. (HKG: 2696) is reportedly in talks with global pharmaceutical giants Johnson & Johnson (J&J, NYSE: JNJ) and Roche (SWX: ROG, OTCMKTS: RHHBY) to sell the rights to its experimental HLX43 antibody‑drug conjugate (ADC), which targets the PD‑L1 immune checkpoint. Bloomberg reports that the deal could bring the company a several‑hundred‑million‑dollar upfront payment plus additional milestone payouts, depending on future data releases.

Deal Highlights

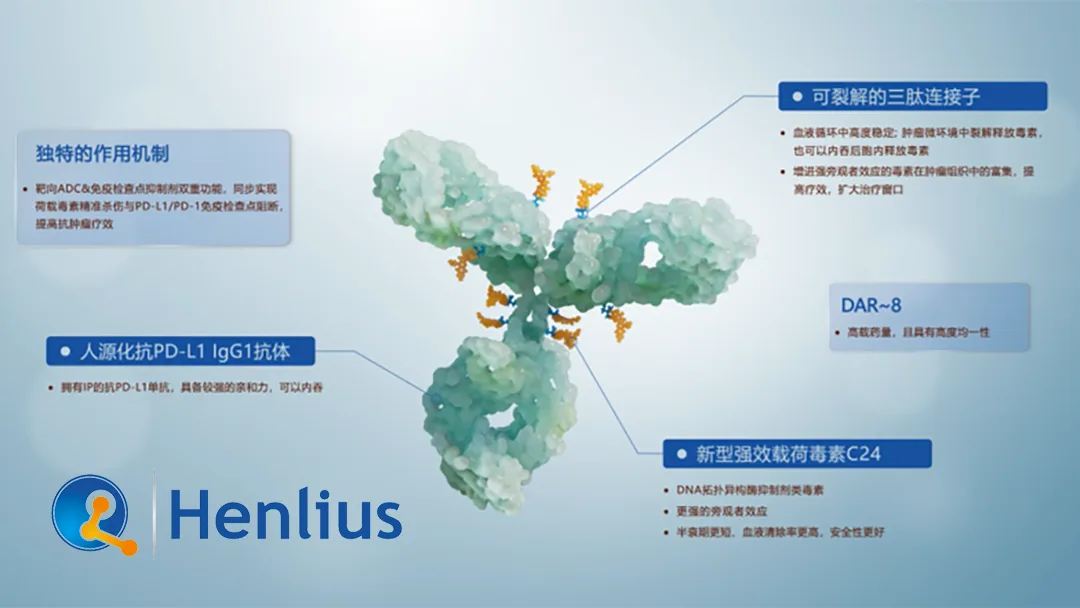

- Product – HLX43, a next‑generation ADC designed to inhibit PD‑L1, potentially enhancing antitumor immune responses.

- Strategic Buyers – Johnson & Johnson and Roche, both heavy‑weights in oncology therapeutics, seeking to expand their ADC pipelines.

- Financial Upside – Initial payment projected in the hundreds of millions, with further milestone payments contingent on preclinical and early‑phase clinical success.

Negotiation Dynamics

- Data‑Driven Valuation – Henlius may push for higher terms as additional efficacy and safety data emerge.

- Uncertain Outcome – No definitive agreement has been reached; the parties are still negotiating terms and milestones.

- Competitive Landscape – The ADC market is rapidly evolving, with multiple players vying for the PD‑L1 niche.

Company Context

- Henlius Biotech – A Shanghai‑based biotech focused on antibody‑drug conjugates and other precision oncology modalities.

- Pipeline – HLX43 is currently in the preclinical phase, with promising in‑vitro results against PD‑L1‑expressing tumor models.

Market Implications

- Strategic Fit – Acquiring HLX43 would bolster Johnson & Johnson’s and Roche’s ADC arsenals, potentially accelerating their entry into PD‑L1‑targeted therapies.

- Investor Sentiment – A successful transaction could enhance Henlius’s valuation and provide capital to advance other pipeline assets.-Fineline Info & Tech