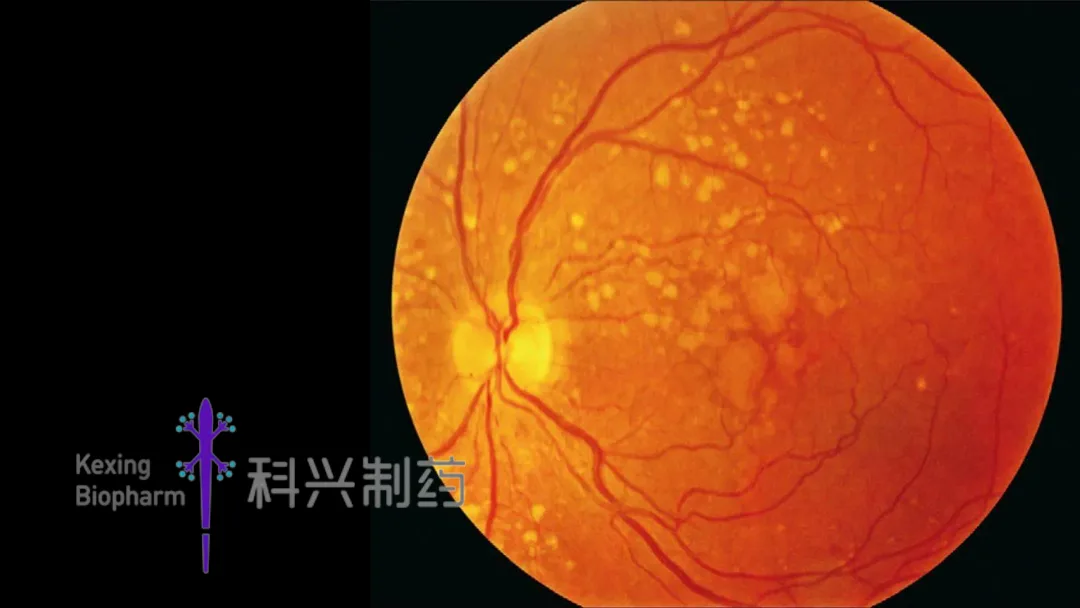

Kexing Biopharm (SHA: 688136) announced that its GB10 injection has received approval from China’s National Medical Products Administration (NMPA) to initiate clinical trials for the treatment of neovascular Age‑related Macular Degeneration (nAMD).

Regulatory Milestone & Product Profile

| Attribute | Details |

|---|---|

| Company | Kexing Biopharm (688136.SH) |

| Product | GB10 injection |

| Approval | NMPA clinical trial approval |

| Indication | Neovascular Age‑related Macular Degeneration (nAMD) |

| Drug Class | Anti‑VEGF/Ang‑2 dual‑targeted antibody |

| Concentration | 140 mg/mL (high‑concentration formulation) |

| Intellectual Property | Global IP rights owned by Shenzhen Kexing Biopharm |

Drug Innovation & Clinical Advantages

Dual‑Target Mechanism

- Anti‑VEGF/Ang‑2 Antibody: Simultaneously blocks two key pathways in nAMD pathogenesis

- High‑Concentration Formulation: 140 mg/mL enables reduced injection volume or increased dosage

Dosing & Compliance Benefits

- Extended Dosing Interval: Expected to achieve once‑every‑four‑months (Q4M) administration

- Patient Impact: Significantly improves patient compliance vs. current monthly/bimonthly anti‑VEGF therapies

Manufacturing Differentiation

- Ophthalmology‑Specific: Dedicated protein drug formulation for ocular administration

- Independent Development: Fully developed in‑house by Kexing Biopharm

Market Context & Competitive Landscape

| Parameter | Market Insight |

|---|---|

| nAMD Prevalence | ~4 million patients in China; incidence rising with aging population |

| Current Standard | Anti‑VEGF monotherapy (monthly/bimonthly injections) |

| Dosing Burden | Patients require 6‑12 injections annually; compliance remains major challenge |

| Market Size | China nAMD market exceeds $1.5 billion (2024), growing at 8% CAGR |

| Competitive Gap | No approved dual‑target anti‑VEGF/Ang‑2 therapy; Q4M dosing would be first‑in‑class |

| Pipeline Position | GB10 leads Kexing’s ophthalmology franchise; potential platform for other retinal diseases |

Strategic Outlook & Next Steps

- Clinical Development: Phase 1 trial initiation expected Q1 2026; focus on safety and dosing interval validation

- Revenue Potential: Analysts project ¥2‑3 billion (US$280‑420 million) peak China sales by 2030 if approved

- Global Strategy: NMPA approval may support IND filings in US/EU via manufacturing and preclinical data

- Platform Expansion: High‑concentration technology applicable to other ocular indications (DME, RVO, etc.)

Forward‑Looking Statements

This brief contains forward‑looking statements regarding GB10 development timelines, clinical outcomes, and market potential. Actual results may differ due to clinical, regulatory, and competitive uncertainties.-Fineline Info & Tech