Cryofocus Medtech (Shanghai) Co., Ltd. (HKG: 6922) announced that its Anti-Gastroesophageal Reflux System has been approved by the National Medical Products Administration (NMPA) of China for treating gastroesophageal reflux disease (GERD).

Regulatory Milestone & Device Profile

| Attribute | Details |

|---|---|

| Company | Cryofocus Medtech (Shanghai) Co., Ltd. (HKG: 6922) |

| Product | Anti-Gastroesophageal Reflux System |

| Approval | NMPA (China) |

| Device Components | Anti-reflux implant device + esophageal measurement tool |

| Indication | Gastroesophageal reflux disease (GERD) |

| Procedure | Magnetic sphincter augmentation |

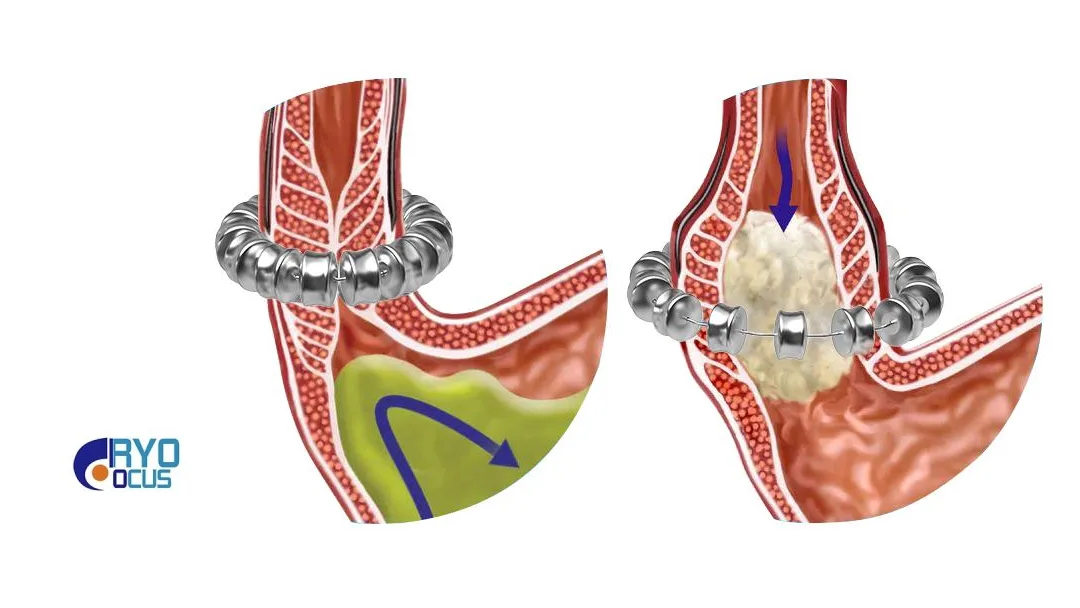

| **Mechanism | Increases lower esophageal sphincter (LES) tension to achieve anti-reflux effect |

Innovation & Technical Differentiation

- Self-Developed: Proprietary surgical device designed and manufactured in China with full IP ownership

- Dual-Component System:

- Implant Device: Magnetic beads that augment LES function

- Measurement Tool: Enables precise esophageal assessment for optimal device sizing and placement

- Minimally Invasive: Laparoscopic implantation procedure vs. traditional fundoplication surgery

- Reversible: Device can be removed if necessary, preserving future treatment options

Market Context & Competitive Landscape

| Parameter | Market Insight |

|---|---|

| GERD Prevalence | 80 million diagnosed patients in China; 200 million experience symptoms |

| Current Standard | Proton pump inhibitors (PPIs) dominate; surgical fundoplication for refractory cases |

| Surgical Gap | Only 2-3% of refractory patients undergo surgery due to invasiveness and complications |

| Market Size | China GERD device market projected at ¥5 billion (US$700 million) by 2028 |

| Competitive Position | First NMPA-approved magnetic sphincter augmentation system; vs. imported devices priced at US$15,000-20,000 |

| Adoption Driver | Minimally invasive alternative for PPI-refractory patients |

Strategic Outlook & Commercial Path

- Launch Timeline: Commercial rollout expected Q2 2026 following hospital procurement processes

- Pricing Strategy: Expected to price at 30-40% discount to imported competitors; potential for national reimbursement listing given innovative device status

- Manufacturing: Shanghai facility will scale production to 5,000 units annually by 2027

- Clinical Support: Post-market studies planned to generate real-world evidence vs. long-term PPI use

- Pipeline Expansion: Platform technology may be adapted for other sphincter disorders (e.g., anal incontinence)

Forward‑Looking Statements

This brief contains forward‑looking statements regarding commercialization timelines, market penetration, and clinical adoption of the Anti-Gastroesophageal Reflux System. Actual results may differ due to regulatory, competitive, and reimbursement uncertainties.-Fineline Info & Tech