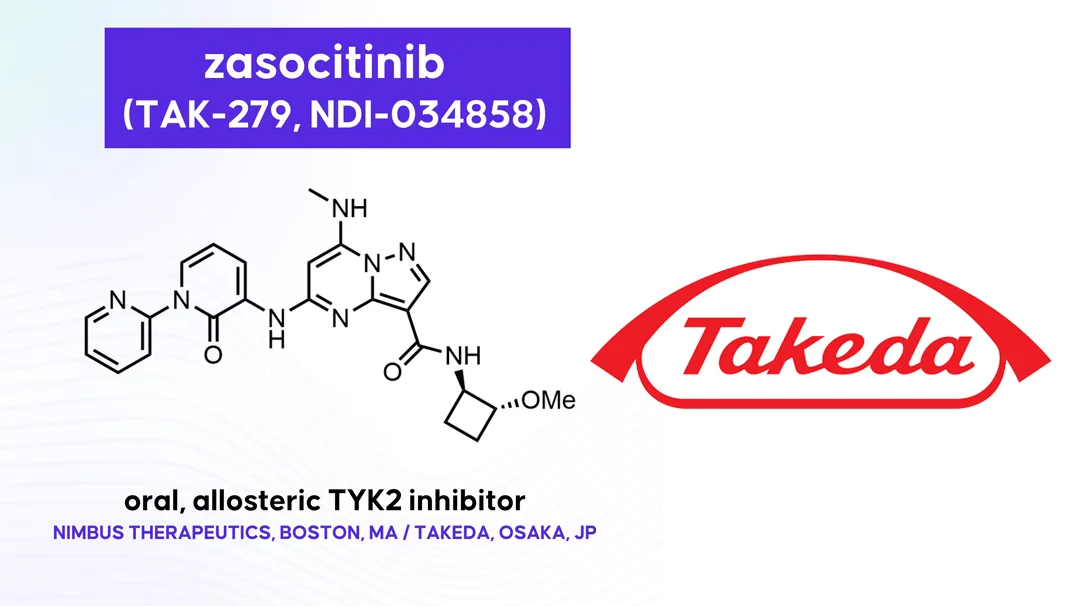

Takeda Pharmaceutical Company (TYO: 4502, NYSE: TAK) announced positive topline results from two pivotal Phase III trials of Zasocitinib (TAK‑279), a next‑generation, highly selective oral TYK2 inhibitor, in adult patients with moderate‑to‑severe plaque psoriasis. The data positions Zasocitinib as a potentially leading oral treatment for immune‑mediated inflammatory diseases.

Phase III Study Results & Drug Profile

| Attribute | Details |

|---|---|

| Company | Takeda Pharmaceutical Company (TYO: 4502, NYSE: TAK) |

| Product | Zasocitinib (TAK‑279) |

| Drug Class | Oral, highly selective tyrosine kinase 2 (TYK2) inhibitor |

| Study Design | Two pivotal Phase III, randomized, multicenter, double‑blind, placebo‑ and active‑controlled trials |

| Indication | Moderate‑to‑severe plaque psoriasis (PsO) |

| Selectivity | >1 million times more selective for TYK2 vs. JAK1, JAK2, JAK3 |

| **Mechanism | 24‑hour inhibition of IL‑23 and core immune pathways driving disease |

Clinical Pipeline Expansion

| Indication | Phase | Status |

|---|---|---|

| Plaque Psoriasis | Phase III | Results announced; head‑to‑head vs. Deucravacitinib ongoing |

| Psoriatic Arthritis | Phase III | Trials in progress |

| Crohn’s Disease | Phase II | Active enrollment |

| Ulcerative Colitis | Phase II | Active enrollment |

| Vitiligo | Phase II | Active enrollment |

| Hidradenitis Suppurativa (HS) | Clinical assessment | Evaluation commencing soon |

Market Context & Competitive Position

- Psoriasis Market: Global market valued at $20 billion (2024), with oral therapies capturing increasing share

- TYK2 Inhibitor Landscape: BMS’s Deucravacitinib currently leads; Zasocitinib’s superior selectivity could differentiate

- Unmet Need: Patients seek effective oral alternatives to injectable biologics; continuous 24‑hour pathway inhibition offers potential advantage

- Pipeline Value: Multi‑indication platform could drive $5‑10 billion peak sales potential if successful across all programs

Strategic Outlook & Next Steps

- Regulatory Filings: US NDA submission for psoriasis expected Q2 2026; EU submissions planned for H2 2026

- Combination Potential: Head‑to‑head data vs. Deucravacitinib will inform positioning; combination studies with topicals being explored

- Manufacturing: Oral small molecule enables cost‑effective production vs. biologics

- Commercial Launch: Takeda preparing global launch infrastructure; targeting 2027 market entry

Forward‑Looking Statements

This brief contains forward‑looking statements regarding Zasocitinib development timelines, clinical outcomes, and market potential. Actual results may differ due to clinical, regulatory, and competitive uncertainties.-Fineline Info & Tech