Suzhou Zelgen Biopharmaceuticals Co., Ltd. (SHA: 688266) announced a strategic collaboration and licensing option agreement with AbbVie Inc. (NYSE: ABBV) for the global development and commercialization of ZG006 (Alveltamig), a novel trispecific T-cell engager targeting DLL3 for small cell lung cancer (SCLC) and other DLL3-expressing malignancies. AbbVie gains exclusive rights outside Greater China while Zelgen retains domestic rights.

Deal Overview

| Item | Detail |

|---|---|

| Licensor | Suzhou Zelgen Biopharmaceuticals (688266.SH) |

| Licensee | AbbVie Inc. (NYSE: ABBV) |

| Product | ZG006 (Alveltamig) – trispecific T-cell engager (TCE) |

| Target | DLL3 (Delta-like ligand 3) |

| Territory | Ex-Greater China (excludes Mainland China, Hong Kong, Macau) |

| Structure | Strategic collaboration + licensing option |

| Indications | Small cell lung cancer (SCLC) and other DLL3-expressing cancers |

Financial Terms & Value Creation

| Component | Amount | Structure |

|---|---|---|

| Initial Payment | USD 100 million | Upfront, non-refundable |

| Progress Payments | Up to USD 60 million | Tied to clinical milestones & licensing option exercise |

| Milestone Payments | Up to USD 1.075 billion | Upon AbbVie exercising option (regulatory & commercial) |

| Total Deal Value | Up to USD 1.235 billion | Excluding royalties |

| Royalties | High‑single to mid‑double digits | Tiered on net sales ex‑Greater China |

Royalties Only on Ex‑China Sales: Zelgen retains 100% of economics in Greater China, projected to represent 25‑30% of global DLL3‑targeting market.

Product Profile: ZG006 (Alveltamig)

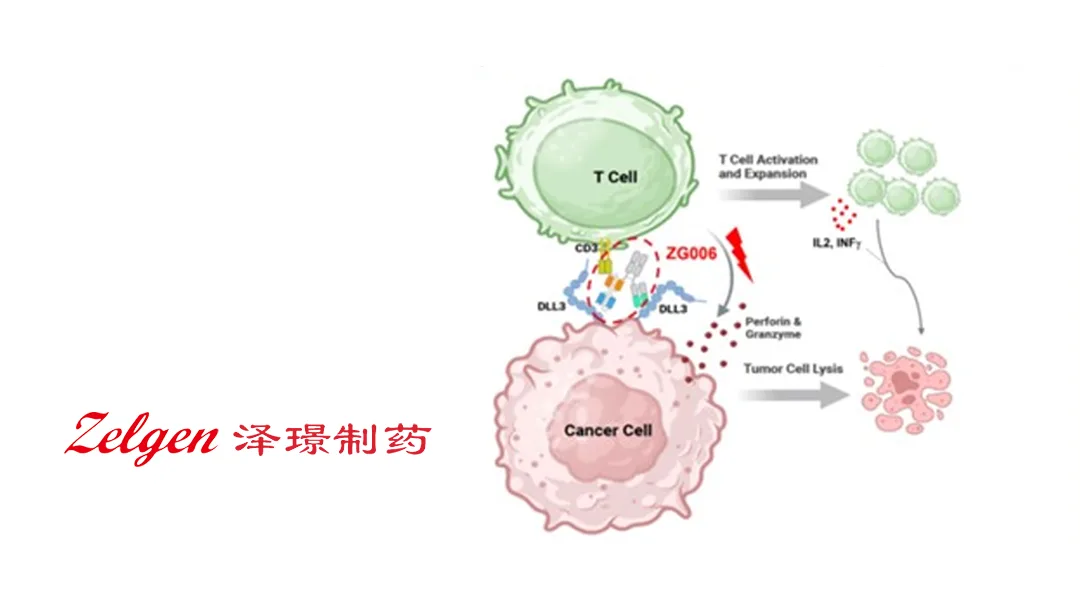

Technology: Trispecific T‑cell engager (TCE) designed to redirect T cells to DLL3‑expressing tumor cells via simultaneous CD3 and dual DLL3 binding domains.

Regulatory Status:

- FDA: Clinical trial approval granted; Orphan Drug Designation received

- NMPA: Clinical trial approval granted

- CDE Breakthrough Therapy Designation: For relapsed/progressive advanced SCLC and DLL3‑positive neuroendocrine carcinoma

Development Stage: Late‑stage clinical development; pivotal trials ongoing in US and China.

Market Significance: DLL3 is expressed in >80% of SCLC tumors and neuroendocrine carcinomas, with no approved targeted therapies beyond chemotherapy.

Market Opportunity: DLL3‑Targeting Landscape

Small Cell Lung Cancer (SCLC) Market:

- Global Incidence: 250,000 new cases annually (US: 35,000; China: 70,000)

- 5‑Year Survival: 7% for extensive‑stage disease; massive unmet need

- Current Standard: Platinum‑based chemotherapy + immunotherapy (limited duration of response)

Addressable Market:

- Ex‑China Market: ¥35‑40 billion (US$5‑6 billion) peak potential by 2032

- China Market: ¥12‑15 billion (US$1.7‑2.1 billion) peak potential

- Target Population: Refractory/relapsed SCLC patients post‑1L therapy (eligible for ZG006)

Neuroendocrine Carcinoma Expansion: Additional 50,000 patients annually ex‑China, representing 30% upside to SCLC‑only opportunity.

Competitive Landscape

| Drug | Company | Mechanism | Stage | Differentiation |

|---|---|---|---|---|

| ZG006 | Zelgen → AbbVie | Trispecific TCE (DLL3 x CD3) | Phase III | Trispecific design; Breakthrough/OOD status |

| Tarlatamab | Amgen | Bispecific TCE (DLL3 x CD3) | Phase III (US) | Bispecific; PDUFA date Q2 2026 |

| Rovalpituzumab | AbbVie (legacy) | ADC (DLL3) | Terminated (MERU trial failed) | Historical failure creates need |

| Rova‑T | AbbVie (legacy) | ADC (DLL3) | Terminated | Reinforces TCE approach |

Strategic Position: ZG006’s trispecific architecture may offer improved avidity and reduced toxicity vs. Amgen’s bispecific tarlatamab, positioning it as a best‑in‑class contender.

Strategic Rationale & Synergies

For Zelgen:

- Non‑Dilutive Capital: USD 160 million upfront/progress payments fund China development without equity raise

- Ex‑China Leverage: AbbVie’s global oncology infrastructure (2,000+ reps) accelerates ex‑China commercialization

- Risk Mitigation: Retains Greater China rights in highest‑growth market while monetizing rest of world

For AbbVie:

- Pipeline Gap Fill: Replaces failed Rova‑T and complements Imbruvic etirement with next‑gen oncology asset

- Late‑Stage Asset: Phase 3‑ready program reduces time‑to‑market vs. internal discovery

- China Optionality: Option structure allows strategic flexibility pending clinical data readout

Development & Commercialization Timeline

| Milestone | Target Date | Responsibility |

|---|---|---|

| Phase 3 Initiation | Q1 2026 (US), Q2 2026 (China) | Zelgen (China), AbbVie (ex‑China) |

| Pivotal Data Readout | H2 2027 (SCLC) | Shared development committee |

| FDA/EMA NDA Filing | Q1 2028 (if positive) | AbbVie (ex‑China) |

| NMPA NDA Filing | Q2 2028 (China) | Zelgen |

| Commercial Launch | 2029 (ex‑China), 2029‑2030 (China) | AbbVie/Zelgen respective territories |

Forward‑Looking Statements

This brief contains forward‑looking statements regarding ZG006’s clinical development, regulatory approvals, market opportunity, and financial contributions to Zelgen and AbbVie. Actual results may differ materially due to clinical trial outcomes, competitive dynamics, regulatory review timelines, and market access challenges.-Fineline Info & Tech