Frontier Biotechnologies Inc. (SHA: 688221) announced that it has submitted an Investigational New Drug (IND) application to the National Medical Products Administration (NMPA) for FB7013 Injection, a self‑developed siRNA drug targeting MASP‑2 for the treatment of primary immunoglobulin A nephropathy (IgA nephropathy), marking the world’s first siRNA therapy to address this complement pathway.

Regulatory & Product Milestone

| Item | Detail |

|---|---|

| Product | FB7013 Injection |

| Company | Frontier Biotechnologies Inc. (688221.SH) |

| Regulatory Status | IND submitted to NMPA |

| Indication | Primary IgA nephropathy |

| Mechanism | siRNA targeting MASP‑2 (lectin pathway) |

| Significance | First‑in‑Class potential; first siRNA targeting MASP‑2 globally |

| Expansion Potential | Membranous nephropathy, diabetic kidney disease |

Mechanism of Action & Differentiation

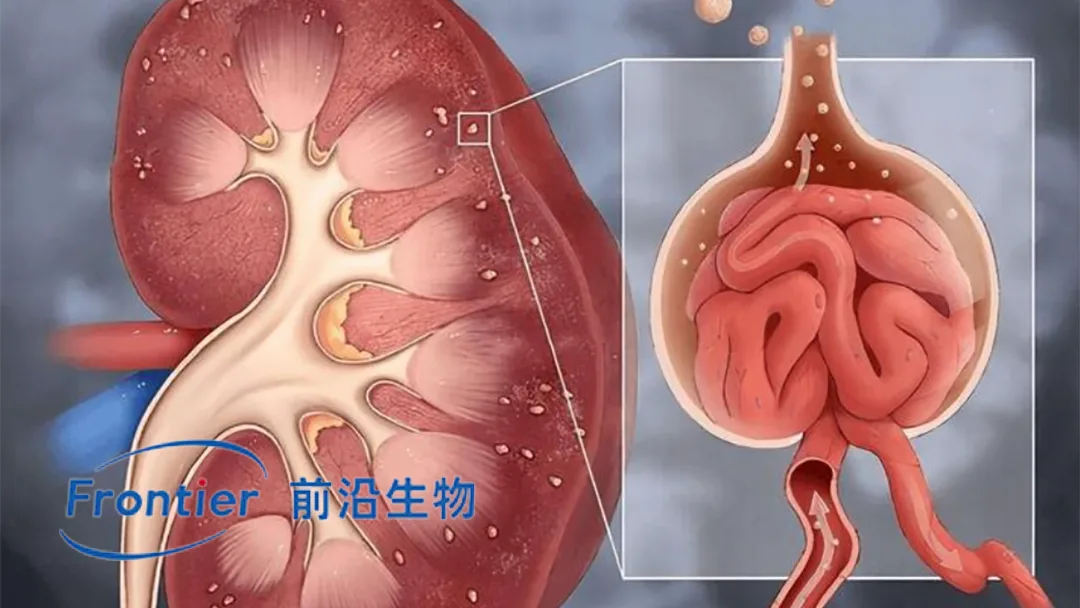

MASP‑2 Target: FB7013 specifically inhibits MASP‑2 (mannan‑binding lectin serine protease 2), a key protein in the lectin pathway of the complement system. By blocking abnormal complement activation, FB7013 reduces complement‑mediated kidney tissue damage.

siRNA Advantages:

- Long‑acting: Potential for quarterly dosing vs. daily oral therapies

- Targeted: Direct knockdown of disease‑driving protein in the liver

- Safety: Avoids systemic immunosuppression seen with steroids or calcineurin inhibitors

Clinical Gap: Current therapies (ACEi/ARBs, steroids, Nefecon) manage symptoms but do not address complement‑mediated injury; FB7013 offers disease‑modifying potential.

Market Opportunity & Disease Burden

IgA Nephropathy in China:

- Prevalence: ~50,000‑70,000 patients with primary IgA nephropathy requiring advanced therapy

- Annual Incidence: 5‑8 per 100,000 → 70,000‑110,000 new cases annually

- Market Size: China IgA nephropathy drug market valued at ¥2.5 billion (2025), growing at 12% CAGR

- High‑Risk Progressors: 30‑40% develop end‑stage kidney disease within 20 years

Expansion Indications:

- Membranous Nephropathy: ~30,000 eligible patients

- Diabetic Kidney Disease: 3‑5 million patients with complement activation → ¥10 billion+ market potential

Competitive Landscape

| Therapy | Company | Mechanism | Stage (China) | Annual Cost (¥) |

|---|---|---|---|---|

| Nefecon | Calliditas/Pfizer | Targeted release budesonide | Approved (2023) | ¥80,000‑100,000 |

| Atrasentan | Chinook/Novartis | Endothelin A antagonist | Phase III | Not yet priced |

| Sparsentan | Travere | Dual ERA/ARB | Phase III | Not yet priced |

| FB7013 | Frontier Biotech | siRNA targeting MASP‑2 | IND submitted | ¥120,000‑150,000 (projected) |

| Standard of Care | Various | ACEi/ARBs, steroids | Marketed | ¥5,000‑10,000 |

First‑Mover Advantage: FB7013 is 24‑36 months ahead of the next MASP‑2 targeting therapy (OMS906 from Omeros, Phase II).

Clinical Development Plan

| Phase | Design | Primary Endpoints | Timeline |

|---|---|---|---|

| Phase I | Dose escalation in IgA nephropathy | Safety, PK, MASP‑2 knockdown | Initiate Q2 2026 |

| Phase II | Efficacy cohort vs. placebo | Proteinuria reduction, eGFR stabilization | 2027 |

| Phase III | Registration trial vs. standard of care | Kidney failure prevention | 2028‑2029 |

| NDA Filing | Rolling submission to NMPA | – | Target 2030 |

Orphan Drug Strategy: Eligible for Orphan Drug Designation in China (prevalence <200,000), providing 7‑year market exclusivity.

Forward‑Looking Statements

This brief contains forward‑looking statements regarding FB7013’s clinical development pathway, market opportunity, regulatory strategy, and peak sales potential. Actual results may differ materially due to clinical trial outcomes, competitive dynamics, and regulatory review timelines.-Fineline Info & Tech