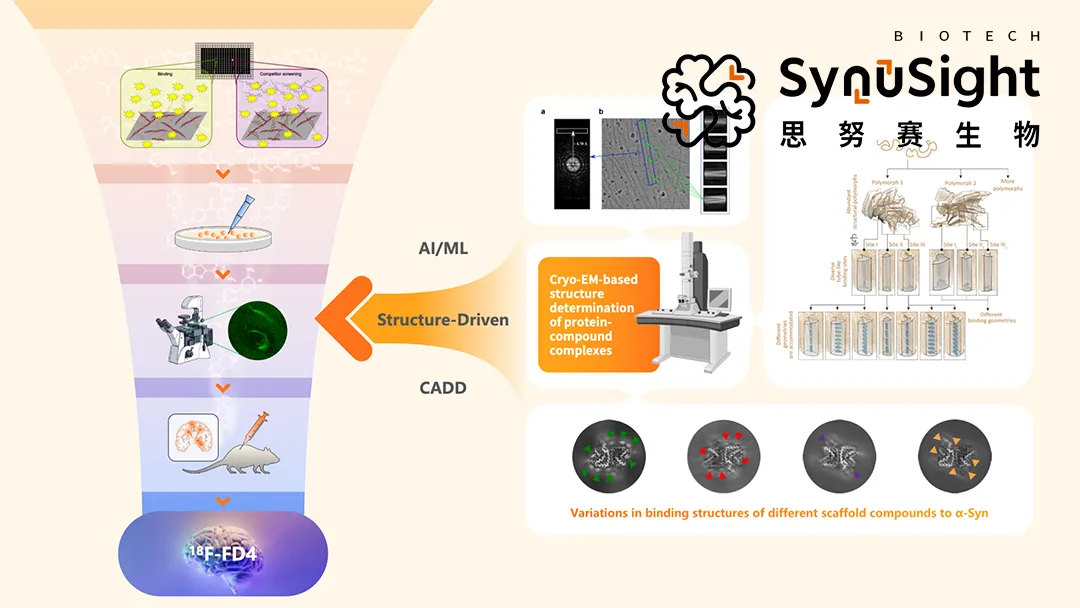

Mabwell (688062.SH) announced that its incubated investment company, SynuSight Biotech, has signed a non‑exclusive clinical use licensing agreement with ABLi Therapeutics for 18F‑FD4, a radioactive PET tracer that images α‑synuclein pathological aggregates in Parkinson’s disease (PD) patients. The tracer will be combined with ABLi’s c‑Abl kinase inhibitor, risvodetinib, in clinical trials to evaluate treatment efficacy.

Deal Overview

| Item | Detail |

|---|---|

| Licensor | SynuSight Biotech (Mabwell incubated investment) |

| Licensee | ABLi Therapeutics |

| Product | 18F‑FD4 (radioactive PET tracer for α‑synuclein aggregates) |

| Use | Combination with risvodetinib in Parkinson’s disease trials |

| Agreement Type | Non‑exclusive clinical use license |

| Financial Terms | Upfront payment + subsequent licensing fees |

Technology Profile: 18F‑FD4 PET Tracer

Mechanism: 18F‑FD4 is a positron emission tomography (PET) tracer designed to visualize α‑synuclein pathological aggregates in the brain, providing quantitative imaging of disease pathology.

Clinical Application: The tracer will enable ABLi to measure α‑syn aggregation levels before and after treatment with risvodetinib (c‑Abl kinase inhibitor), offering robust efficacy evidence complementary to existing blood and tissue biomarkers.

Market Significance: First PET tracer for α‑synuclein pathology in clinical use licensing in China, addressing a critical unmet need for objective PD progression monitoring.

Parkinson’s Disease Market Context

Disease Burden:

- China Prevalence: ~3 million Parkinson’s patients (2025), growing at 8% CAGR due to aging population

- Diagnostic Challenge: No definitive objective biomarker for α‑syn pathology; diagnosis relies on clinical symptoms

- Treatment Gap: 40‑50% of patients progress to severe disability within 10 years despite existing therapies

Market Opportunity:

- China PD Drug Market: ¥8.5 billion (2025), projected ¥15 billion by 2030

- PET Imaging Market: ¥2.3 billion (2025), growing at 15% CAGR

- Tracer Revenue Potential: ¥500‑800 million peak sales for 18F‑FD4 if widely adopted in clinical trials and routine monitoring

Competitive Landscape

| Product | Company | Target | Stage | Application |

|---|---|---|---|---|

| 18F‑FD4 | SynuSight/ABLi | α‑synuclein PET | Clinical trials | Treatment monitoring |

| PiB | Various | Amyloid PET | Marketed | Alzheimer’s |

| Tauvid | Lilly | Tau PET | Marketed | Alzheimer’s |

| α‑synuclein tracer | AC Immune/ Roche | α‑synuclein PET | Phase II | Diagnostic |

First‑Mover Advantage: 18F‑FD4 is 12‑18 months ahead of competitors in the Chinese PD imaging market.

Financial Implications

SynuSight Upside:

- Upfront Payment: Undisclosed (estimated USD 2‑5 million based on clinical licensing benchmarks)

- Licensing Fees: USD 5‑10 million tied to trial milestones and commercial adoption

- Royalty Potential: If 18F‑FD4 transitions to commercial diagnostic use, mid‑single digit royalties on sales

Mabwell Valuation Impact: The licensing agreement validates SynuSight’s platform technology and enhances Mabwell’s biotech incubation model, potentially increasing Mabwell’s stake value by 10‑15%.

Strategic Rationale

For SynuSight/Mabwell:

- Technology Monetization: Converts proprietary PET tracer into near‑term cash flow

- Platform Validation: Demonstrates biomarker development capability for neurodegenerative diseases

- Pipeline Leverage: Positions Mabwell to incubate additional neuro‑imaging assets

For ABLi Therapeutics:

- Efficacy Biomarker: 18F‑FD4 provides objective endpoint for risvodetinib trials, de‑risking PD program

- Regulatory Advantage: PET‑based endpoints may accelerate FDA/NMPA approval pathways

- Market Differentiation: First PD therapy with imaging‑confirmed target engagement

Mabwell’s Incubation Model

SynuSight Biotech: One of 5‑7 incubated companies within Mabwell’s biotech accelerator, focusing on CNS imaging and therapeutics.

Portfolio Strategy: Mabwell plans to spin out SynuSight via IPO or trade sale in 2027‑2028, targeting $300‑500 million valuation based on 18F‑FD4 clinical data and pipeline expansion.

Forward‑Looking Statements

This brief contains forward‑looking statements regarding 18F‑FD4’s clinical utility, licensing fees, and market adoption. Actual results may differ materially due to clinical trial outcomes, competitive dynamics, and regulatory acceptance of imaging biomarkers in PD.-Fineline Info & Tech