Prelude Therapeutics (NASDAQ: PRLD) unveiled a suite of strategic shifts: it signed an option deal with Incyte for its JAK2V617F mutant selective inhibitor, set the KAT6A selective degrader as a top priority for ER⁺ breast cancer, and halted its SMARCA2 degrader program to re‑focus resources.

Strategic Highlights

| Update | Detail |

|---|---|

| Option Agreement | Incyte secured an exclusive option to acquire Prelude’s undisclosed JAK2V617F mutant‑selective inhibitor program for myeloproliferative neoplasms (MPNs). |

| Pipeline Re‑prioritisation | Prelude promotes its first‑in‑class KAT6A selective degrader for ER⁺ breast cancer to 2026 clinical read‑iness. |

| Program Pause | Clinical development of the SMARCA2 degrader program is paused pending resource reallocation. |

Incyte’s Exclusive Option on JAK2V617F

- Transaction Details – Incyte pays an upfront fee and invests equity in Prelude, with future milestone payments, royalties, and downstream terms contingent on development progress.

- Ownership Structure – Prelude retains all assets and development rights until the option is exercised; post‑exercise, Incyte will spearhead global development and commercialization.

- Strategic Match – The JAK2V617F JH₂ mutant is a highly sought‑after target in MPNs, positioning Incyte to expand its oncology pipeline.

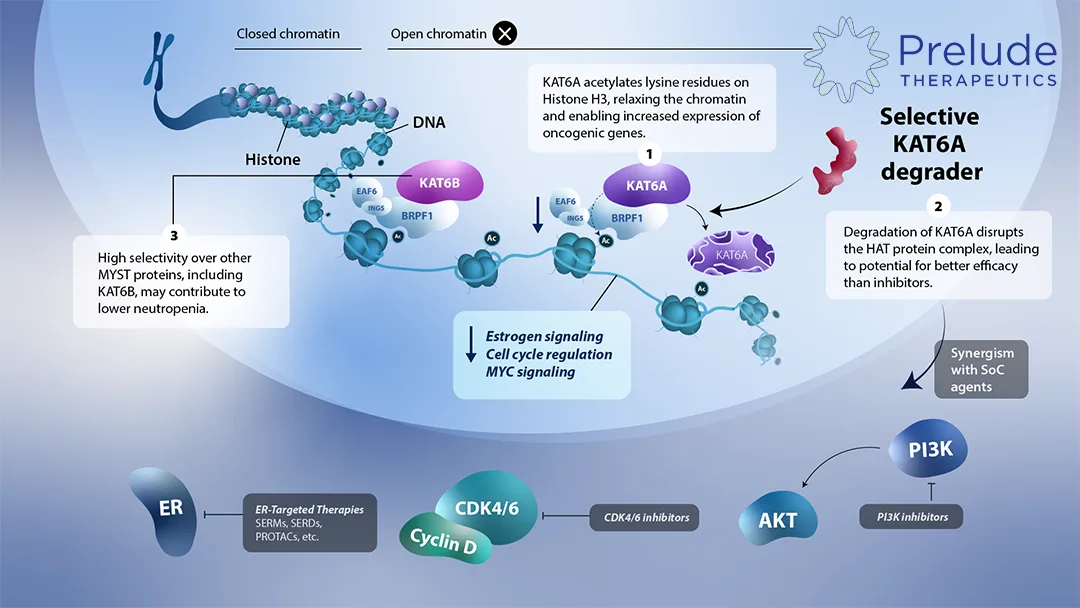

KAT6A Degrader – A First‑In‑Class Innovation

- Target Logic – Selective degradation of KAT6A offers a differentiated therapeutic window versus the broader KAT6A/B inhibitors that are in clinical trials.

- Clinical Roadmap – Prelude plans to launch phase I/II studies in 2026, aiming for proof‑of‑concept data that could reveal superior efficacy or safety compared to non‑selective agents.

- Commercial Imperative – ER⁺ breast cancer remains a high‑need area; a selective degrader could capture significant market differentiation.

SMARCA2 Program Pause

- Data‑Driven Decision – Comprehensive review of current data indicated limited incremental benefit relative to resource commitment.

- Capital Allocation – The pause reflects a strategic choice to funnel capital toward the more promising JAK2 and KAT6A pipelines, aligning with value‑inflection points.

Market and Investor Implications

- Capital Efficiency – Prelude’s realignment signals disciplined stewardship of R&D budgets, potentially easing investor concerns about dilution and burn.

- Therapeutic Landscape – The JAK2V617F alliance strengthens Incyte’s MPN offerings, while the KAT6A degrader adds a novel tool to the breast cancer armamentarium.

- Stock Performance – The option deal adds upside potential for Prelude through equity upside and future royalties, while the pause removes a lower‑prioritised asset from the pipeline.

Bottom Line

Prelude Therapeutics’ November 2025 updates recalibrate its research portfolio: securing Incyte’s option on a transformative JAK2V617F program, prioritising a cutting‑edge KAT6A degrader for ER⁺ breast cancer, and temporarily halting the SMARCA2 degrader to optimise resource deployment. These moves sharpen Prelude’s focus and enhance its attractiveness to investors seeking high‑impact oncology innovation.-Fineline Info & Tech