Suzhou Zelgen Biopharmaceuticals Co., Ltd. (SHA: 688266) announced that its trispecific antibody ZG006 (alveltamig) has been granted Orphan Drug Designation (ODD) by the U.S. Food and Drug Administration (FDA) for the treatment of neuroendocrine carcinomas (NECs). The designation provides tax‑credit incentives, market‑exclusivity extensions, and regulatory support for the first‑in‑class therapy.

Transaction & Regulatory Summary

| Item | Detail |

|---|---|

| Company | Suzhou Zelgen Biopharmaceuticals Co., Ltd. (SHA: 688266) |

| Product | ZG006 (alveltamig) – trispecific T‑cell engager |

| Indication | Neuroendocrine carcinomas (NEC) |

| FDA Action | Orphan Drug Designation (ODD) – 20 Nov 2025 |

| Other Approvals | Clinical‑trial clearance from FDA (IND) and China NMPA |

| Platform | Bispecific/Multispecific antibody R&D platform |

| Target | Dual epitopes of DLL3 (Notch pathway) + CD3 (T‑cell) |

Science & Mechanism

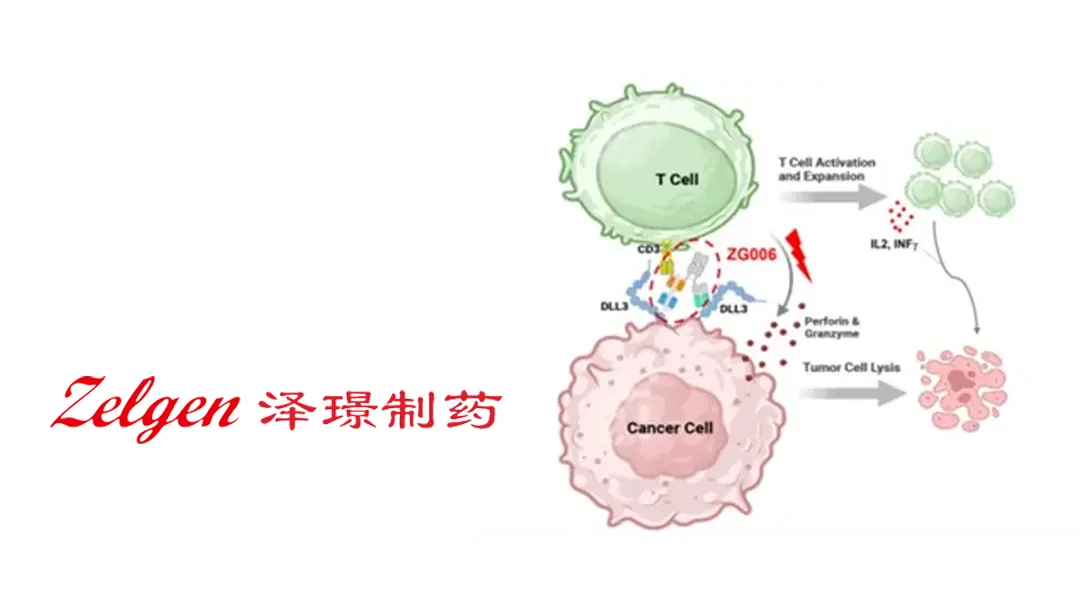

- Trispecific Architecture: ZG006 simultaneously binds two distinct DLL3 epitopes (over‑expressed on NEC cells) and CD3 on T‑cells, forming a stable immunologic synapse that redirects cytotoxic T‑cells to the tumor.

- First‑in‑Class Potential: By engaging two tumor‑associated epitopes, ZG006 aims to overcome antigen‑escape mechanisms that limit conventional bispecifics.

- Pre‑clinical Proof‑point: In murine xenograft models of DLL3‑positive NEC, a single dose of ZG006 produced > 80 % tumor regression with durable responses lasting > 30 days.

Development Timeline

| Milestone | Expected Date |

|---|---|

| Phase I IND‑enrollment (US) | Q1 2026 |

| Phase I IND‑enrollment (China) | Q2 2026 |

| Interim analysis (dose‑escalation) | Q4 2026 |

| Phase II/III launch (US & China) | 2028‑2029 (contingent on Phase I safety) |

Market Impact & Financial Outlook

- NEC Landscape: Neuroendocrine carcinomas affect ~ 150,000 patients globally, with limited targeted options and a 5‑year survival < 15 %.

- Revenue Potential: Assuming a U.S. market share of 5 % after approval, ZG006 could generate ≈ US$300 million in annual sales (based on a projected price of US$150,000 per patient course).

- Orphan Incentives: FDA ODD grants 7‑year market exclusivity and tax credits up to US$2 million for clinical‑trial expenses, improving the project’s net‑present‑value.

- Funding: Zelgen has earmarked RMB 200 million (~US$28 million) for Phase I‑II activities, with additional capital being explored through strategic partnerships and secondary listings.

Forward‑Looking Statements

This brief contains forward‑looking statements regarding regulatory outcomes, clinical development, and commercial expectations for ZG006. Actual results may differ due to risks including clinical‑trial results, regulatory approvals, competitive dynamics, and market adoption.-Fineline Info & Tech