Johnson & Johnson (J&J, NYSE: JNJ) announced a definitive agreement to acquire Halda Therapeutics in an all‑cash transaction valued at USD 3.05 billion. The acquisition gives J&J immediate access to Halda’s lead asset, HLD‑0915, a first‑in‑class oral RIPTAC (Regulated Induced Proximity Targeting Chimeras) candidate for metastatic castration‑resistant prostate cancer (mCRPC).

Deal Overview

| Item | Detail |

|---|---|

| Acquirer | Johnson & Johnson (NYSE: JNJ) |

| Target | Halda Therapeutics (private) |

| Transaction value | USD 3.05 billion cash |

| Closing timeline | Expected Q2 2026, subject to customary regulatory approvals |

| Strategic rationale | Expand J&J’s oncology pipeline with a novel oral small‑molecule platform and accelerate entry into the high‑growth mCRPC market |

HLD‑0915 – Clinical & Mechanistic Highlights

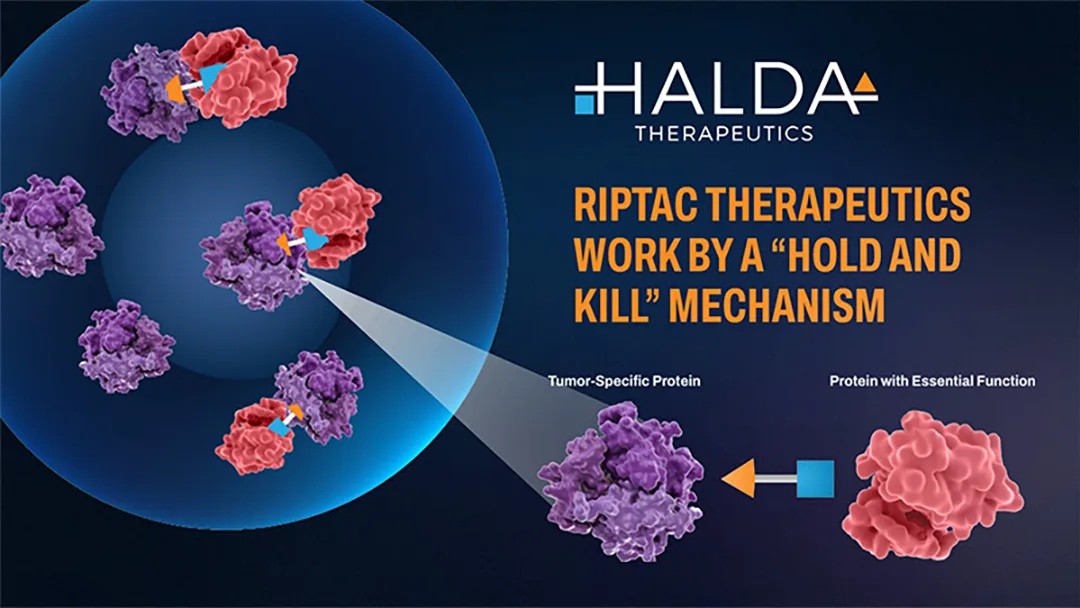

- Mechanism of Action – A bifunctional small‑molecule that simultaneously binds the androgen receptor (AR) and the epigenetic regulator BRD4, forcing a ternary complex that selectively disables BRD4 activity in prostate‑cancer cells.

- Phase I/II data (presented Oct 2025) –

- Safety: Well‑tolerated; ≤ 15 % Grade 3+ adverse events.

- Efficacy signals: Median PSA decline ≥ 50 % in 38 % of patients; RECIST partial responses in 22 % of evaluable lesions.

- Pharmacokinetics: Oral bioavailability > 60 % with steady‑state exposure achieved by Day 7.

- Pre‑clinical proof‑of‑concept – Oral dosing in resistant mCRPC xenografts produced > 45 % tumor‑volume reduction and sustained PSA suppression, demonstrating a favorable therapeutic index even in BRD4‑resistant models.

Market Implications

- mCRPC landscape – The global mCRPC market is projected to exceed $12 billion by 2028, driven by an aging male population and the need for oral therapies that overcome resistance to current androgen‑axis drugs.

- Revenue upside – Assuming a 10 % market share of the oral mCRPC segment (≈ 200,000 patients) at an average price of $120,000 per patient per year, HLD‑0915 could generate ≈ $24 billion in peak annual sales.

- Strategic fit for J&J – The acquisition complements J&J’s existing oncology assets (e.g., Darzalex, Imbruvica) and provides a platform that could be adapted to other AR‑driven or BRD4‑dependent malignancies.

Forward‑Looking Statements

This brief contains forward‑looking statements regarding the acquisition, clinical data, and market potential of HLD‑0915. Actual results may differ due to clinical outcomes, regulatory actions, competitive dynamics, and other risk factors.-Fineline Info & Tech