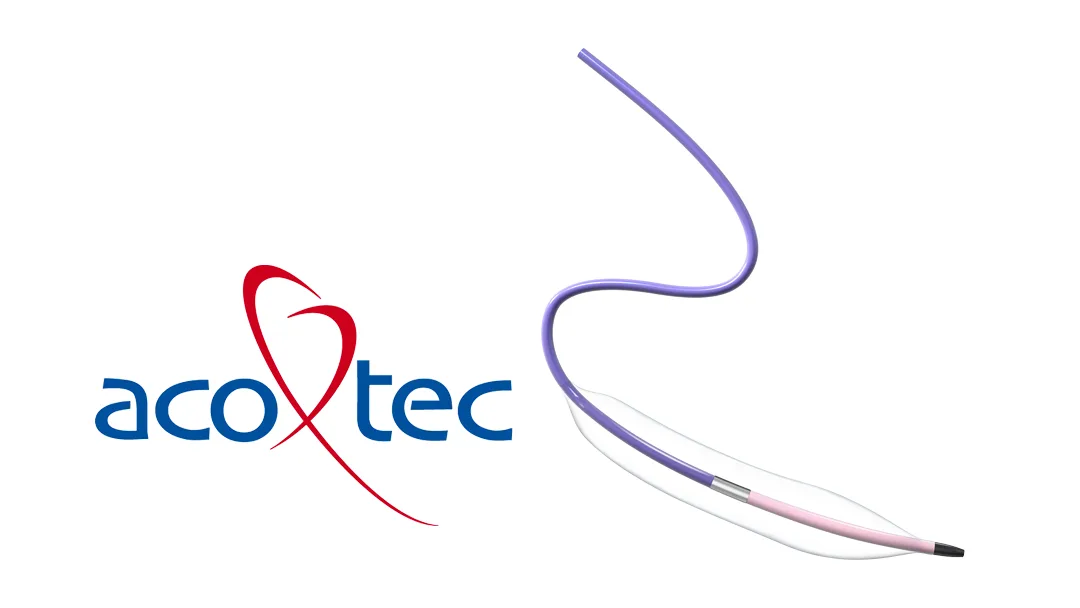

Acotec Scientific Holdings Limited (HKG: 6669) announced that China’s National Medical Products Administration (NMPA) has approved its Jingyi Coronary Over‑the‑Wire (OTW) Balloon Dilatation Catheter, a semi‑compliant device engineered for chronic total occlusion (CTO) and severely calcified lesions, marking Acotec’s entry into the premium complex PCI segment.

Regulatory Milestone

| Item | Detail |

|---|---|

| Product | Jingyi Coronary Over‑the‑Wire Balloon Dilatation Catheter |

| Company | Acotec Scientific Holdings (HKG: 6669) |

| Agency | NMPA (China) |

| Approval Type | Registration approval |

| Indications | Dilating coronary artery/bypass graft stenosis; post‑stent dilation (2.0‑5.0 mm balloons) |

| Key Features | Semi‑compliant, OTW design, optimized crossability/pushability |

| Target Lesions | CTO, severe calcification |

| Commercial Launch | Expected Q1 2026 |

Product Profile

- Design: Semi‑compliant balloon with smaller distal tip profile and tighter folding profile for enhanced lesion crossing

- Delivery System: Optimized catheter construction provides superior pushability in tortuous anatomy

- OTW Configuration: Over‑the‑Wire design improves procedural efficiency and safety by enabling rapid wire exchanges and stable guidewire position

- Size Range: Balloon diameters 2.0‑5.0 mm cover both focal lesions and post‑stent optimization

- Clinical Gap: Addresses unmet need for reliable CTO and calcified lesion dilation where standard balloons fail in 15‑20% of cases

Market Context & Outlook

| Metric | Value |

|---|---|

| China PCI Procedures (2024) | 2.1 million |

| Complex Lesion Share | ~15% (315,000 procedures) |

| Premium Balloon Market Size | ¥4.5 billion (US$620 million) |

| Growth Rate | 12% CAGR (2024‑2030) |

| Jingyi ASP | ¥8,000‑12,000 per unit (premium vs. ¥3,000‑5,000 standard) |

| Revenue Forecast (Peak) | ¥500‑700 million (US$70‑95 million) by 2028 |

| Market Share Target | 10‑15% of complex lesion segment |

- Competitive Landscape: Dominated by Boston Scientific (Emerge, NC), Medtronic (Marathon), and Abbott (Hi‑Torque) in complex lesions; domestic players MicroPort and Lepu focus on basic balloons

- Differentiation: Jingyi’s OTW platform offers comparable performance to market leaders at 20‑30% lower price, appealing to tier‑2/3 hospitals expanding PCI capabilities

- Strategic Value: Elevates Acotec from basic interventional portfolio to premium complex lesion solutions, supporting average selling price (ASP) uplift across product mix

- Reimbursement Path: Likely classified under existing balloon dilation catheter reimbursement codes; no additional price negotiations required

Forward‑Looking Statements

This brief contains forward‑looking statements regarding Jingyi’s commercial launch timeline, market penetration, and revenue contribution. Actual results may differ materially due to risks including competitive responses, hospital procurement cycles, and physician adoption rates.-Fineline Info & Tech