Jiangsu Hengrui Pharmaceuticals Co., Ltd. (SHA: 600276, HKG: 1276) announced that HRS-5346, the centerpiece of a USD 1.97 billion licensing agreement with Merck & Co., Inc. (MSD, NYSE: MRK), has been granted Breakthrough Therapy Designation (BTD) by the Center for Drug Evaluation (CDE) of China’s National Medical Products Administration (NMPA) for the treatment of elevated lipoprotein(a) [Lp(a)] levels.

Deal Structure & Regulatory Milestone

| Item | Detail |

|---|---|

| Company | Jiangsu Hengrui Pharmaceuticals (SHA: 600276, HKG: 1276) |

| Drug | HRS-5346 (oral small‑molecule Lp(a) inhibitor) |

| Designation | Breakthrough Therapy Designation (CDE/NMPA) |

| Indication | Elevated lipoprotein(a) levels |

| Global Partner | Merck & Co., Inc. (NYSE: MRK) |

| Deal Value | USD 1.97 billion (upfront + milestones + royalties) |

| Licensing Date | March 2024 (global rights out‑licensed to Merck) |

| Strategic Significance | Validates HRS-5346’s potential in cardiovascular disease prevention |

Drug Profile & Mechanism of Action

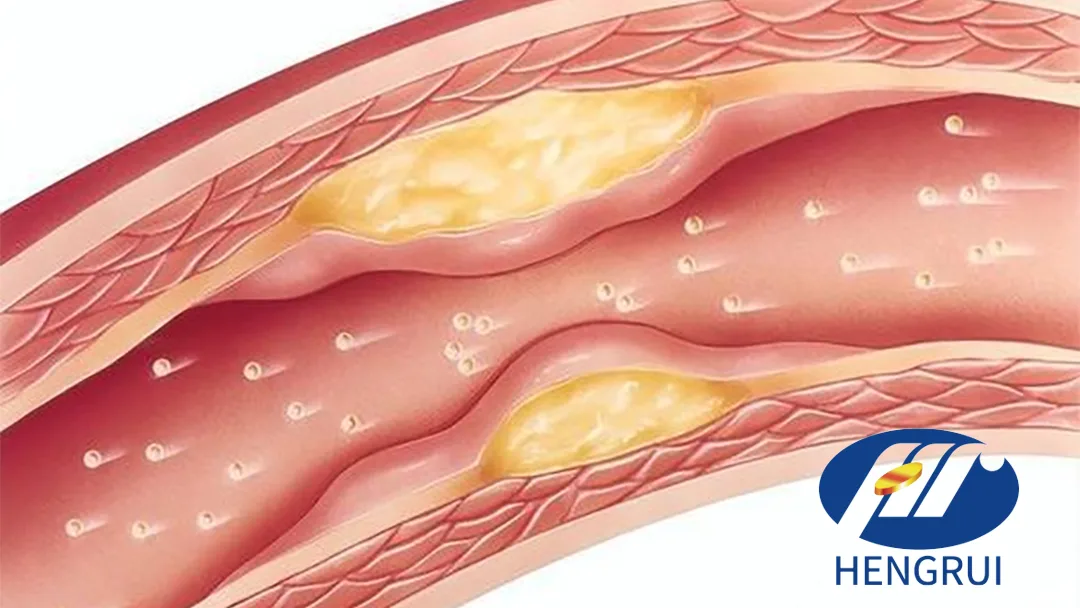

- Mechanism: Oral small‑molecule inhibitor specifically targeting lipoprotein(a) [Lp(a)], a particle resembling LDL cholesterol

- Pathophysiology: Lp(a) is an independent risk factor for atherosclerotic cardiovascular diseases, including coronary heart disease, ischemic stroke, peripheral vascular disease, and calcific aortic valve stenosis

- Innovation: Represents a significant breakthrough in lipid‑lowering therapy, addressing a target with no currently approved oral drugs

- Market Need: ~20% of global population has elevated Lp(a) levels, creating a multibillion‑dollar market opportunity

Market Impact & Commercial Outlook

- Cardiovascular Disease Burden: Leading cause of death worldwide; Lp(a)‑driven risk remains largely untreated despite statin therapy

- Competitive Landscape: Novelis (siRNA, Novartis) and pelacarsen (ASO, Novo Nordisk) are in Phase III; HRS-5346’s oral small‑molecule profile offers dosing convenience advantage

- Revenue Potential: Analysts project $3–5 billion peak global sales if approved, based on broad patient eligibility and preventive care model

- Strategic Validation: BTD accelerates China regulatory pathway; Merck’s $1.97 billion bet underscores global commercial confidence

- China Significance: Breakthrough designation enables priority review and potential 2027 NDA approval, ahead of global timelines

- Next Steps: Merck to initiate global Phase III program in Q2 2026; Hengrui to support China registration with BT‑enabled accelerated development

Forward‑Looking Statements

This brief contains forward‑looking statements regarding development timelines, regulatory pathways, and revenue projections for HRS-5346. Actual results may differ due to clinical trial outcomes, competitive dynamics, and regulatory review processes.-Fineline Info & Tech