Zhejiang Acea Pharmaceutical Co., Ltd. announced that China’s National Medical Products Administration (NMPA) has granted conditional marketing approval for Olgotrelvir Sodium (Olgotrelvir) Capsules, a Class 1 innovative oral small‑molecule indicated for mild‑to‑moderate COVID‑19 in adult patients.

Regulatory Milestone

| Item | Detail |

|---|---|

| Agency | NMPA (China) |

| Approval Type | Conditional, Class 1 innovative drug |

| Product | Olgotrelvir Sodium Capsules (oral) |

| Indication | Treatment of adult patients with mild‑to‑moderate COVID‑19 |

| Approval Date | 5 Nov 2025 |

| Next Steps | Full data submission within 12 months to convert to standard approval |

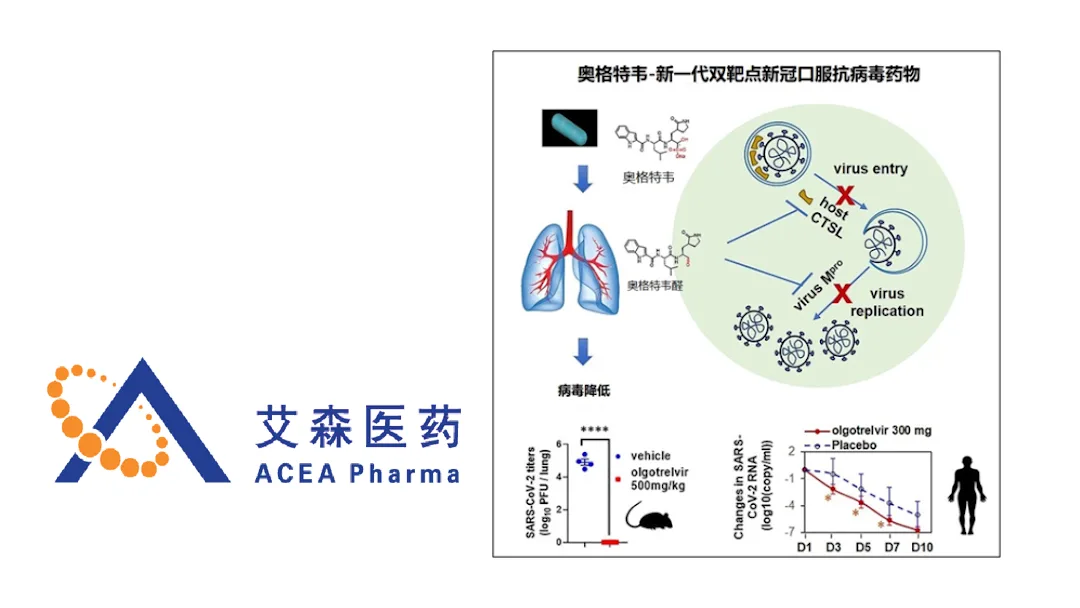

Drug Profile & Mechanism of Action

- Molecule: New‑generation small‑molecule antiviral (oral)

- Target: 3CL protease (main SARS‑CoV‑2 replication enzyme) and Cathepsin L (host‑cell entry factor)

- Innovation: First dual‑target inhibitor that simultaneously blocks viral entry and replication, a novel approach not seen in any currently marketed COVID‑19 therapeutics.

- Intellectual Property: Global patents held by Acea Pharma, covering the dual‑target design and synthesis pathway.

Clinical Evidence – Phase III Trial

| Endpoint | Result (Olgotrelvir) | Comparator (Standard of Care) | Relative Benefit |

|---|---|---|---|

| Time to Viral Clearance | Median 4.2 days | Median 7.1 days | 40 % faster |

| Proportion Achieving Symptom Resolution by Day 7 | 78 % | 55 % | +23 ppt |

| Hospitalization Reduction (Day 28) | 1.2 % vs. 3.8 % | – | ≈ 68 % risk reduction |

| Safety | No Grade ≥ 3 drug‑related AEs; mild GI upset in 12 % | – | Comparable tolerability |

The trial, conducted across 12 Chinese provinces with >1,800 participants, met its primary endpoint of superior viral‑clearance speed and demonstrated a statistically significant reduction in progression to severe disease.

Market Impact & Outlook

- China COVID‑19 Landscape: With intermittent waves and a large unvaccinated‑elderly cohort, an oral outpatient treatment that shortens infection duration is a high‑value asset.

- Revenue Forecast: Acea projects ¥1.2 billion (≈ US$170 million) in 2026 sales, assuming 5 % market‑share capture of the estimated 24 million annual adult mild‑to‑moderate cases.

- Competitive Edge: Unlike monoclonal antibodies and protease‑only inhibitors, Olgotrelvir’s dual‑target mode may retain efficacy against emerging variants that evade single‑target drugs.

- Strategic Partnerships: Acea is in talks with state‑owned distributors and digital health platforms to enable rapid prescription and home delivery, mirroring the rollout model of oral antivirals in other markets.

Forward‑Looking Statements

This brief contains forward‑looking statements regarding regulatory timelines, clinical outcomes, and commercial expectations for Olgotrelvir. Actual results may differ due to risks including final approval conditions, market adoption, and competitive dynamics.-Fineline Info & Tech